Solar for your business

Solar energy is financially and environmentally beneficial for your businesses. With a well-designed solar system, you can save money by replacing an ongoing operating expense (your electric bill) with a capital investment that yields significant financial and tax benefits.

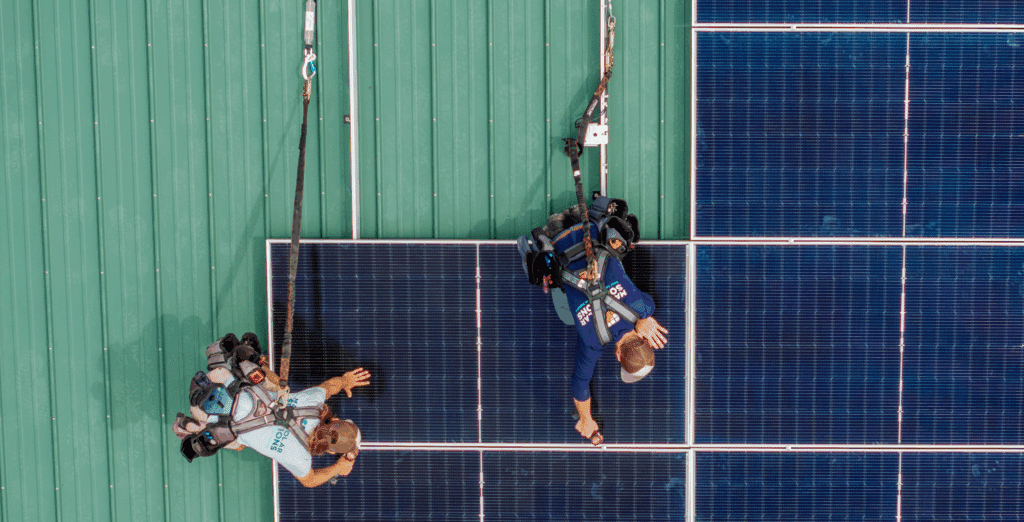

Commercial solar experts

Whether you own a small business, a large facility, or oversee a farm or school, we’re here to make the transition to solar seamless with expert guidance and professional installations and support.

Incentives and savings for your business

Reduce operating costs and move toward energy independence by generating your own clean, reliable energy.

Increase your property value. A solar-equipped building can increase in value by up to $20 for every dollar it generates annually.

Boost your brand reputation and appeal to eco-conscious consumers by demonstrating your commitment to sustainability.

Future-proof against energy inflation for 30+ years.

Deduct 30% of the cost of your solar system—including battery backup systems—through the Federal Investment Tax Credit (ITC)*.

Boost your returns under the Modified Accelerated Cost Recovery System (MACRS), which allows businesses to depreciate solar systems in the first 5 years. Generate additional income with Renewable Energy Credits (REC), tradable certificates that represent the environmental benefits of generating renewable energy.

Breaking down the ROI of solar

See how a commercial solar system can deliver significant savings and financial benefits. In this scenario, the customer’s grid-powered electric bill is $1,000 per month ($12,000 per year).

Investment and Incentives

| total system & installation cost: $138,000 | This includes solar panels, inverters, installation work, and warranties. |

| *federal itc (30%): $41,400 | Businesses can deduct 30% of the system cost from their federal taxes. |

| *depreciation benefits $42,780 | Depreciation refers to a reduction in the value of an asset over time. Under the Modified Accelerated Cost Recovery System (MACRS), businesses can typically depreciate solar systems in the first 5 years. |

| net cost after incentives: $53,820 | Your net cost after Federal ITC and depreciation. |

Annual savings and income

| electric bill savings: $12,000 | In this example, the customer saves $12,000 annually. |

| renewable energy credits (REC) Revenue: $1,620 | RECs are tradable certificates that represent the environmental benefits of generating renewable energy. |

| Total annual savings & income: $13,620 | This is the sum of your electric bill savings ($12,000) and REC revenue ($1,620), which together generate $13,620 in annual savings and income. |

| 30-year internal rate of return (IRR): 26% | IRR measures investment returns over time. A 26% IRR means a business can expect a 26% annual return on its investment over 30 years. |

| payback period: 5 years | The payback period is the time it takes for the system to pay for itself through savings and income. |

| 30-year savings | $351,665 |

| Finacing Options | You can also finance your solar system. For this sample, that would be $988/month as a fixed payment. While utility rates climb, your electric costs stay locked in for the next 30+ years. Your 30-year savings with financing: $272,113 |

*Maine Solar Solutions does not provide tax, legal, or financial advice. Please consult a tax professional to confirm your company’s eligibility for federal incentives.

Get started with a free site assessment

During our solar site assessment, our experts will evaluate your property, offer tailored recommendations and custom designs, and present the best solutions to fit your budget and energy goals.